Blog

- All

- College Planning

- Insights

- Market Updates

- New Jersey Personal Finance Newsletter

- Psyched Up About Money

- Retirement

I’m retired. Can I still get a mortgage?

December 29, 2022

Retirement

Reading Time: 6 minutes It’s very common for us to get questioned about whether or not a retiree can get a mortgage. Some retired people feel stuck; they want to change ...

December newsletter

December 1, 2022

Insights

Reading Time: < 1 minute Happy holidays and please enjoy our final newsletter of the year!

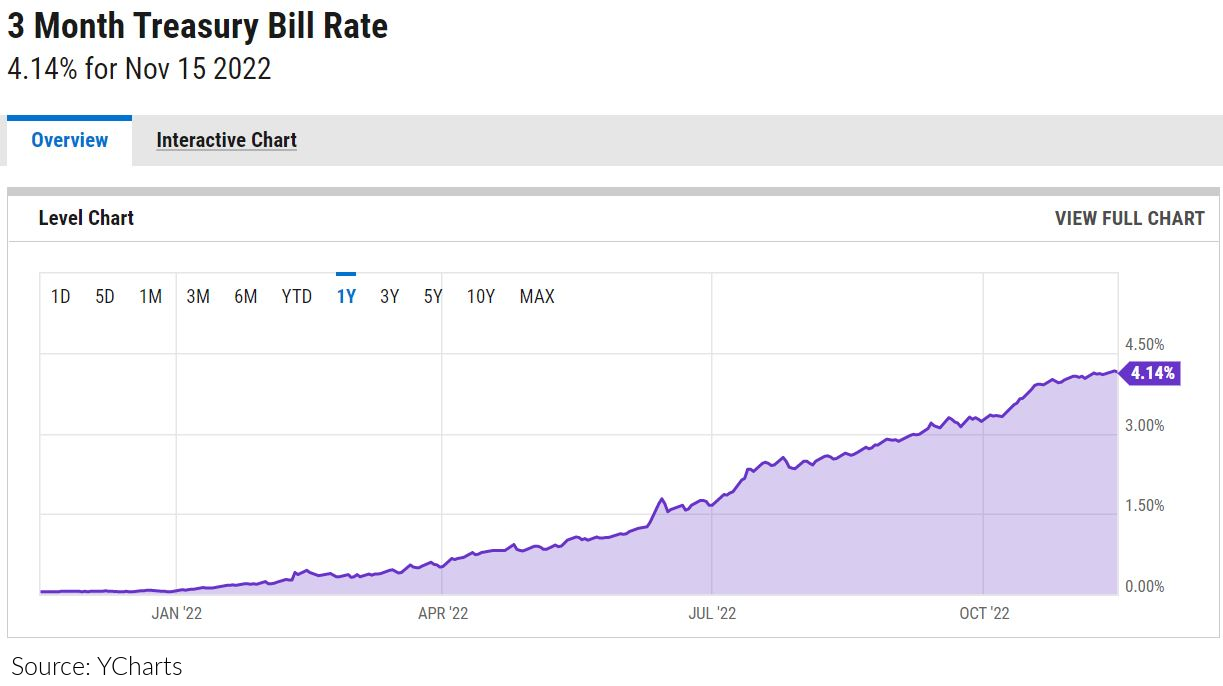

Are Treasury Bills the safe asset of 2023?

November 25, 2022

Insights

Reading Time: 3 minutes Markets are volatile, inflation hasn’t gone away, and geopolitical instability is still a “thing.” Is there a safe asset where you can park your money? Let’s talk ...

Charitable Giving in a Down Market

November 1, 2022

Market Updates

Reading Time: < 1 minute This month we seem to be getting a great deal of questions about giving to charity in a down market, and we’ve answered them in the ...

A guide to retirement for private practice psychiatrists

October 26, 2022

Psyched Up About Money

Reading Time: 4 minutes As a private practice psychiatrist, you wear many hats: you’re a physician, a counselor, a business owner, and a person who goes home and goes to sleep ...

What’s the deal with the Merck 401k plan?

October 19, 2022

Insights

Reading Time: 5 minutes Merck, headquartered in Rahway, New Jersey, is a popular employer for many residents of the Garden State. As part of our blog series on retirement in New ...

October newsletter: Will inflation ever end?

October 3, 2022

Insights

Reading Time: < 1 minute Here are the most common questions we were asked last month. If you’d like us to answer your questions in next month’s newsletter, please send them ...

The Johnson & Johnson 401(k) plan – everything you need to know

September 28, 2022

Insights

Reading Time: 6 minutes New Jersey is home to some of America’s greatest pharmaceutical companies, namely Johnson & Johnson which has its headquarters in New Brunswick. In this blog we’ll talk ...