Markets are volatile, inflation hasn’t gone away, and geopolitical instability is still a “thing.” Is there a safe asset where you can park your money? Let’s talk about Treasury Bills whose appeal seems to have risen like the phoenix from the ashes lately.

We’ll talk about:

- What is a Treasury bill?

- What the yields are currently

- Why it makes potentially may make sense to invest in them

- How it may fit into your overall plan

Before we get into the blog, we are financial planners in Morristown, New Jersey. We’ve written other blogs on retirement that may be useful to you:

Does Social Security increase with inflation?

Inflation’s impact on Social Security and retirement

Retirement planning for the self-employed

End of year financial planning

And now let’s get into it!

What is a Treasury Bill?

There is a belief in finance that the most boring aspects as opposed to the shiny objects are where you have potential to gain the most in the long term.

Treasury Bills are not flashy or fun – but they can be a critical store of value in times like these.

The US government issues debt for people and institutions to buy, basically, in the form of bills, bonds, and notes. They do this to fund the Treasury. The short-term debt is the bills (0-1 year), the medium-term debt is notes (2-10 years), and the long-term debt is bonds (10-30 years). These bonds pay interest.

It’s important to recognize that the interest, or yield, the debt instrument pays is inversely proportional to its price. In other words, as the instrument goes down in price, the yield goes up, and vice versa.

Why do people buy Treasury Bills?

As these instruments are backed by the full faith of the US government (which is believed to be unlikely to go bankrupt), Treasury instruments are seen as a form of high-quality debt. Nothing is guaranteed, but as far as the debt market goes, Treasury instruments are some of the safer ones out there.

Are Treasury Bills a safe asset? Here is what the US’s credit is rated by the major agencies, according to Trading Economics:

- Standard & Poor’s, AA+ with stable outlook

- Moody’s, Aaa with stable outlook

- Fitch, AAA with stable outlook

- DBRS, AAA with stable outlook

In recent years, interest rates have been low, causing their yields to drop and appetite for Treasury Bills to cool. However, with interest rates coming back up now, it’s a different story and demand for Treasury Bills has picked back up.

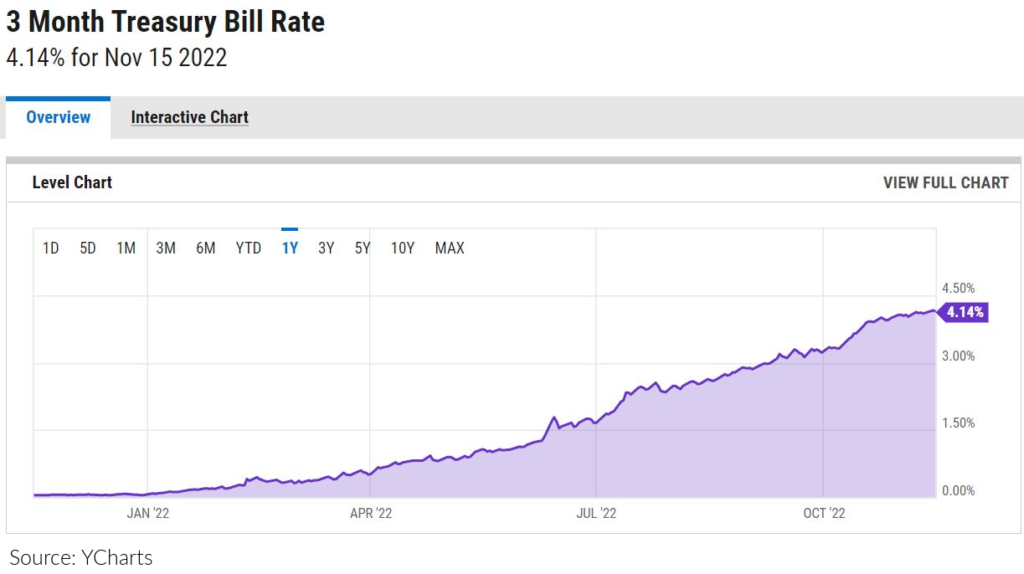

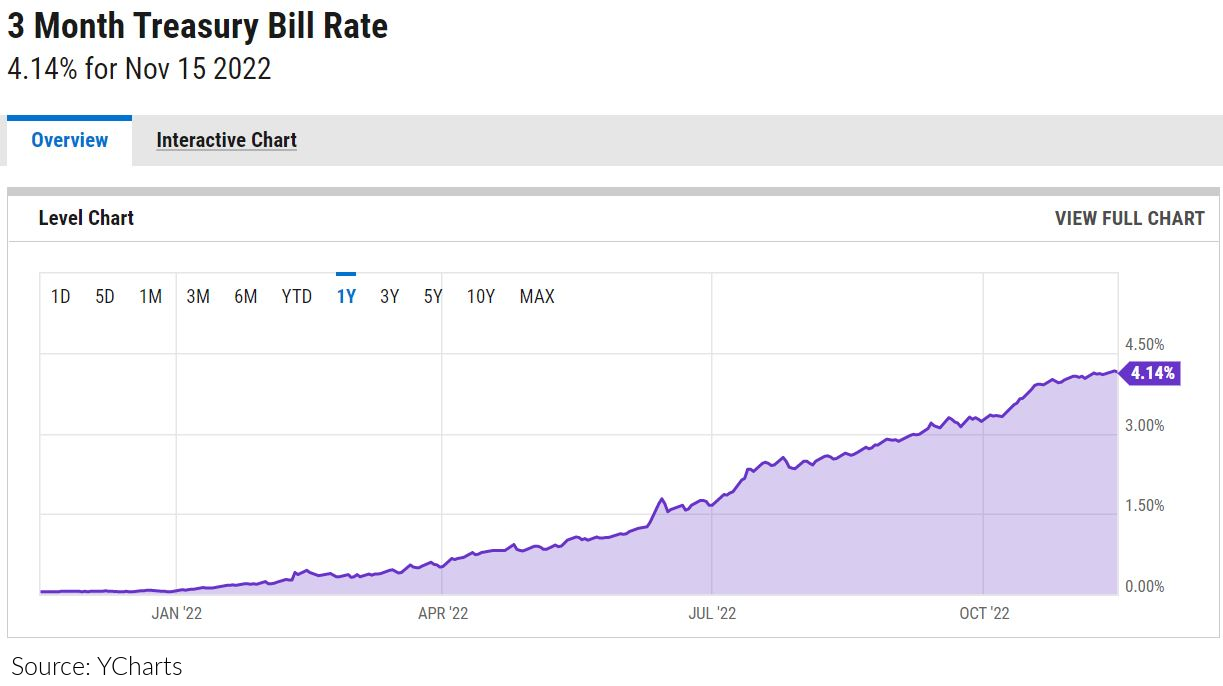

The current moment for yields

As of the time of writing of this article, the T Bill yield has risen to over 4% after a series of several consecutive interest rate hikes by the Fed, as the graph from YCharts below displays.

Are Treasury Bills the “safe asset”

Why do people buy Treasury Bills? In a nutshell:

- Low volatility

- High credit ratings (as previously mentioned)

- Perceived as a “safe asset”

When yields were so low, it was hard to justify buying them, but with the recent rise it is conceivable how this investment may make sense in 2023 and beyond, if yields continue to sustain at these levels.

As a reminder, it’s best to consider your overall financial situation any time you are considering any particular investment. It is wise to map out your goals, whether they be retirement, buying a house, paying down debt, etc., and consider your cash flow needs. Any portfolio decisions should only be made after a thorough risk assessment, and should take your overall income and total return needs into account. Nothing in this article may be interpreted as advice specific to any one individual; for such recommendations it is prudent to contact a financial advisor.

What’s your 2023 portfolio strategy?

We are financial advisors in Morristown, NJ serving the local community and beyond. If you have questions about how to manage your portfolio for 2023, reach out and send us a message.

Sources

TreasuryDirect. Treasury Marketable Securities. Treasury Bills. https://www.treasurydirect.gov/marketable-securities/treasury-bills/

YCharts. 3 Month Treasury Bill Rate. https://ycharts.com/indicators/3_month_t_bill

Trading Economics. United States – Credit Rating. https://tradingeconomics.com/united-states/rating#:~

Disclosures

Nothing contained within this article may be interpreted as a recommendation of any sort. The information presented herein is subject to change at any time, and Glassner Carlton is under no obligation to update it. For recommendations regarding your personal financial situation, contact a financial advisor.