Given the tear that inflation has been on for the last year, concerns about managing expenses have come to the forefront. For many people retired or approaching retirement, whether or not inflation makes Social Security increase is a critical one. If you are asking “does Social Security increase with inflation?”, sit tight – we’re going to explore this topic in our article. We’ll also cover the question of when Social Security is likely to run out, and more!

Let’s face it – inflation is a “thing”

At the time of this blog’s writing, inflation is officially a force to be reckoned with.

According to the BLS, as of May 2022 the CPI all items index had increased 8.6 percent over the last 12 months, the largest increase over such a time period in nearly 40 years. The energy index rose more than 34% over the last 12 months.

Okay, we’ll stop now – this is getting too depressing!

Inflation may rise or fall – but the point here is that when there are large price increases, consumers on a fixed income are feeling the pinch. Having an airtight financial plan is important. If you’re concerned about your retirement strategy, it’s worthy to understand how inflation impacts Social Security.

Is the Social Security Trust Fund running out?

What is Social Security?

It is a Federal benefit for those who are:

- Retired

- Disabled to the point where they can’t work

- The spouse or child of a deceased Social Security benefits recipient

You work and accrue Social Security benefits which are then pooled and managed by the US government in what is called the Social Security Trust fund. Once you reach full retirement age, the benefits are paid to you from the trust fund. The known funding deficit has led many to question if there is even going to be anything left for those entitled to Social Security benefits.

We’ll spare you the minutiae – which is outlined in the 2022 Annual Report from the Social Security Board of Trustees – so here’s the summary version.

- Benefits are going to be reduced by 23% starting in 2034 for OASI, or Old Age and Survivor’s Insurance.

- DI, or Disability Insurance, is not likely to become depleted until 2096.

While the Social Security Trust Fund isn’t going to run down to zero anytime soon, it’s not quite what it used to be. If you are planning on having a dignified retirement, it’s useful to figure out a retirement strategy that takes into account reduced Social Security benefits.

There are already reductions in place, and with the deficit as large as it is, it’s reasonable to envision more on the horizon the further past 2034 we go. Inflation is likely to expedite this – and next we’ll discuss why.

Do social security payments increase with inflation?

Yes, social security increases with inflation.

Every year around October, the Social Security administration releases what is called a Social Security COLA for the year coming up.

Some key details are:

- If there is a Social Security increase, it starts in January.

- You are notified by mail in December. This is called a COLA notice.

- You can also view your COLA notice through your my Social Security account. It’s a good idea to log on here periodically to check your future benefit estimates and other information – many times there can be wrongly reported information that needs to be corrected.

- It’s an automatic change. You don’t have to elect to have your Social Security benefits increased by the COLA.

What is the Social Security COLA based on?

What is the Social Security COLA?

It’s not a soft drink.

COLA stands for “cost of living adjustment.” It’s a mechanism by which your Social Security benefits increase to account for the rising costs of maintaining your daily life.

- The main driver of the COLA is inflation, which we’ve already discussed above.

- Medicare is also a huge driver of the COLA. For those receiving both Social Security and Medicare, Social Security benefits are adjusted by the Social Security Administration after Medicare changes are announced for the year.

- It is based upon CPI-W from the third quarter of the last year a COLA was in effect.

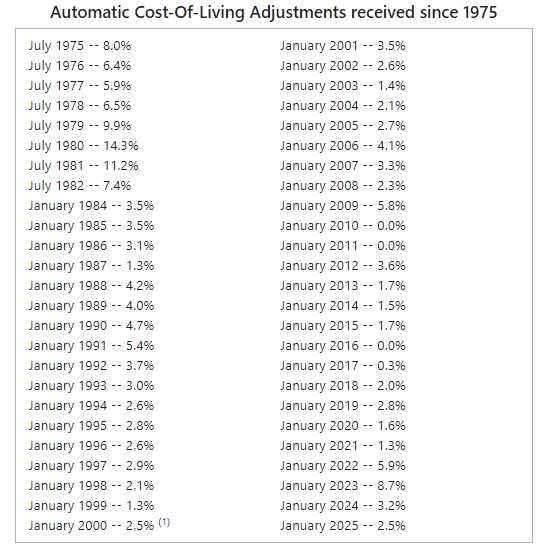

In 2024, the Social Security COLA was declared to be 2.5% for 2025. While this is not as substantial as in years past, the gradual decline of inflation over recent years may have tempered the need for a large increase.

Here is a history of Social Security COLAs since 1975.

Social Security COLA vs. inflation – can you win this battle?

Inflation is measured by the government in various forms, but none of them will accurately capture the experience that any one person has with inflation. Keep this in mind as you contemplate the plight of the Social Security COLA against inflation.

There are many factors related to price increases that you cannot control. It helps to do some financial planning, a process by which you analyze your household costs and the changes they undergo. This exercise is done for each individual or household, and with these results a strategy is created to help you meet your spending and saving goals with (hopefully) less stress.

But what if I own a business?

The Social Security inflation adjustments described above apply to both employees and those who own businesses – how you earn your pay makes no difference in the tabulation of your benefits.

However, as we’ve discussed in our piece about Social Security for the self-employed, the process for paying Social Security taxes is a bit different. A self-employed person pays taxes directly to the IRS. The taxes for any given year are based on what you earned the year prior.

For self-employed people, Social Security works differently than if you were a W-2 employee. As a business owner, you pay taxes for yourself (as the employee) and also as the employer. That is because you are essentially both the employee and the employer at the same time. This is where it gets a tiny bit complicated, so we advise you to consult with your tax advisor or CPA if you have questions on filing taxes as a business owner.

Help – I’m stressed about my Social Security benefits being reduced!

We know; it’s stressful when the wolf is at the door.

The following measures can help.

- Map out all your sources of retirement income (Social Security, investments, etc.)

- Plan out a strategy for retirement as best you can using available information

- Stay on top of the Social Security Administration (SSA)

As for the last point, the SSA does make mistakes when tabulating your income. As with any large, governmental agency, there are many people they need to worry about and limited resources. It’s up to you to stay on top of information such as what the SSA maintains for your wage history (remember, your benefits are based upon your highest 35 earning years), what age you are, where you live, etc.

Retirement is about way more than Social Security increases!

Social Security and inflation, taxes, retirement – all of this can be quite a bit to handle on your own. We are a financial advisor in Morristown, New Jersey serving clients across the country. If you have concerns about the question of Social Security increasing with inflation, your retirement, etc., our process is focused on financial planning. It starts with a conversation about your financial plan, objectives, and investment strategy. If you would like to discuss, let us know.

Sources

Bureau of Labor Statistics, Consumer Price Index Summary, June 10, 2022. Consumer Price Index – May 2022. https://www.bls.gov/news.release/cpi.nr0.htm

Social Security. The 2022 Annual Report Of The Board Of Trustees Of The Federal Old-Age And Survivors Insurance And Federal Disability Insurance Trust Funds. https://www.ssa.gov/OACT/TR/2022/tr2022.pdf

Social Security Administration. SSI Federal Payment Amounts for 2025. https://www.ssa.gov/oact/cola/SSI.html

Social Security. Cost-of-Living Adjustment (COLA) Information for 2025. https://www.ssa.gov/cola/#