In this article you will learn about self-employed Social Security. We’ll cover the basics of Social Security Taxes for self-employed people, and give some suggestions about things to keep in mind as you plan for your retirement.

What is Social Security?

Let’s start with some Social Security basics.

What is Social Security?

Social Security is program run by the US Federal government that pays benefits to those who have either:

- Retired

- Become disabled to the point where they can’t work

- Become the surviving spouse or children of a deceased worker

You accrue credits as you work and pay Social Security taxes, and when you claim your benefits they are paid to you out of a trust fund held by the US government. You can earn up to four Social Security credits a year, and in 2023 every $1,640 in earnings gets you one credit. If you are married and self-employed, your spouse’s Social Security benefit will factor into your benefit award.

Everyone who works in the United States and earns money is required to pay Social Security taxes to the US government. In turn, you are eligible for these benefits. This table from the Social Security Administration reflects the monthly benefit amounts. Retiring at age 70 would produce the largest amount, $4,555 per month in 2023.

You receive a Social Security number that tracks your earnings history. The Social Security Administration uses your best 35 years of earnings in their calculation of your benefits. The rules governing Social Security are made by Congress. Any changes to the policy come into existence through a process of proposal, debate and amendment.

Social Security credits and business owners

It’s necessary that you have the required amount of credits to be eligible for Social Security. Earnings of $1,640 equates to one credit. You need 40 credits, but you can only earn up to four each year.

Maximizing Social Security benefits depends on your earnings. Social Security is based off of your highest 35 years of earnings history. But if you’re self-employed, this can be a rocky road. Some business owners might not even have 35 years of earnings history. For the years that you do have earnings, how profitable your business is, what the business earns, etc. are all enmeshed in the decision you make about how much compensation you take from the business.

It’s a delicate balance

Social Security is one factor that business owners should consider as they contemplate their earnings structure. A business owner usually has control of how much salary to take, and how much of the earnings to reinvest in the business. How do you make sure you take enough salary so you’re not shorting yourself in terms of Social Security credits, while at the same time not starving your business?

You pay Social Security tax on your salary until you reach a limit of $160,200, which is the maximum taxable earnings amount for 2023. By declaring a lower salary, you may wind up with more to invest in your business, but you may wind up having lower earnings recorded in your earnings history – hence reducing your Social Security benefit.

Social Security and S Corps

If you are the owner of an S-Corp, it’s even more complicated.

You can take earnings as a combination of a salary and a dividend, the former going through payroll and counting towards Social Security, and the latter not doing so. How does an S-Corp owner avoid taking too low a salary (with the balance of earnings taken as a dividend) to reduce taxes, if doing so would possibly mean undercutting future Social Security benefits?

It’s a delicate balance, and one that needs to be figured out with a vision of the entire process in mind. Especially when you are operating within an S Corp structure, it’s important to have a command of your entire financial picture. This can be accomplished by sitting down and creating a plan that encompasses topics such as:

- Your future life goals

- Tax planning

- What your estate plan is and whether or not it makes sense

- Your cash flow needs and how to meet them

- Liquidity management, before and after sale of the business.

This is a long term, strategic undertaking and one that requires consistent diligence.

How do you manage the immediate, short-term impact of paying into Social Security on your own? It’s critical for business owners to understand the mechanics. Let’s talk about how you pay into Social Security on your own if you are self-employed.

How the self-employed pay taxes

How you pay into Social Security if you are self-employed is highly connected to how you pay taxes; so let’s take a moment to review. We are assuming that most of you reading this blog are classifying yourselves using terms such as:

- Business owners

- Entrepreneurs

- Freelancers

- 1099 workers

- One’s own boss

- Consultants

- Independent contractors

We’ll get into the specific taxes that self-employed people pay in a little bit, but for now let’s talk about how you pay taxes if you are working for yourself. If you are self-employed, you pay your taxes directly to the IRS. But how do you know what you are going to earn over the course of the year before you actually earn the money? For self-employed people, taxes are estimated using your last year’s business earnings.

These estimated taxes are paid every quarter to the IRS. As these estimates are based upon the prior year’s income, after you file your return each year, the IRS reconciles what you truly owed versus what you paid to them.

Perhaps your estimates were too low. This would be the case if you had a particularly successful year and made much more than you did last year. In this case, you underpaid and additional taxes are due when you file your yearly return. Make sure you do the calculation! If you don’t make up the difference, the IRS will send you a letter informing you that you owe more money.

This is an extremely important detail so we’ll repeat it.

The IRS will send you a letter in the mail. The IRS does not call or email taxpayers. If you get a call or email from someone claiming to be the IRS, it is a fraud. You should ignore and/or block these communications.

Now, let’s say you paid too much. This would be the case if your estimated taxes more than compensated the IRS for the amount you owed. Usually this would result from a scenario in which you had a very good year followed by a not-as-good year (remember, estimated taxes are paid upon last year’s earnings). The IRS will send you a tax refund.

How do self-employed people retire?

Let’s start with the basics here again. What is retirement?

Retirement is defined as the period of time after an individual stops working. Many people use retirement as a time to relax and spend time doing what they truly love, while others opt to work part time or even pursue an “encore career” involving something they are passionate about.

How do people afford to live during retirement? As most people do not work during their retirement, income is derived from the money they put aside in prior years. This can include but it not limited do:

- Social Security benefits

- 401(k) or other employer-sponsored plan distributions

- IRS distributions

- Withdrawals from non-retirement brokerage accounts

- Pensions

- Annuity distributions

- Interest accrued on bonds you hold

- Dividends earned from stocks you hold

Social Security benefits pay a key role in retirement for many people, and it may have a special meaning for a self-employed person. Let’s think about what a business owner lives off of during retirement.

- If you have a big business, you probably have started some kind of employer-sponsored retirement account for you and your employees (401(k), defined benefit plan, etc.)

- If you are a sole proprietor, you may have established some kind of vehicle such as a SEP IRA.

- You may have sold your business completely, cashed out, and invested the distribution.

- You may have sold part of your business and retained a partial stake, continuing to receive some income.

- You’ll likely be eligible for Social Security benefits

Social Security can be a very important part of this equation. Let’s say you have a highly transaction type of business (example, divorce attorney). When you stop work, the revenue stops coming. In this case, it’s highly important to do the math right and to make sure that while you are earning from your business you save the right amount – because once the business stops, the income stops as well. We’ll talk more about retirement planning later.

But first let’s discuss how self employment affects Social Security benefits.

Self-employed Social Security Tax

Now that we’ve gone over the basics, let’s take a deeper look at how self-employed people pay into Social Security.

What is self-employment tax?

Let’s start with a basic question. What is self employment tax? According to the IRS, self employment taxes are comprised of two parts: Medicare and Social Security taxes.

You only owe Social Security taxes in 2023 on wages up to $160,200. As of July 2023, the rate for these two types of taxes combined is 15.3%, which breaks out as 12.4% for Social Security and 2.9% for Medicare.

How do you file and pay Social Security taxes if you are self-employed? You file Schedule SE through Form 1040 or 1040-SR. For sole proprietors or independent contractors, the form to use is Schedule C.

Straightforward so far?

Here’s where things get a little bit tricky. Now, just to be clear, we aren’t providing any specific tax advice applicable to any one person or business in this blog. For such advice, we would suggest that you consult with a tax advisor. But what we can do is provide general guidelines and that is what we are going to do below.

So let’s carry on, shall we?

Self-employed Social Security works a bit differently than for an employee. An employee pays on his or her portion of Social Security taxes. On your paycheck you see that your employer has withheld a portion of your pay, and sent it to the IRS. They have also paid their portion of these taxes. All without any action required on your behalf.

Done, kaput.

However, as a self-employed person paying into Social Security, you pay these taxes for yourself and also as your own employer. That is because you are essentially the employee and the employer at the same time. In both cases, you are the one doing the withholding. Here’s another key difference: you get to deduct the employer-equivalent portion of these taxes when you are figuring out what your gross income is. To be clear, this deduction reduces your income, not your earnings. As a result it will only affect the amount of income tax that you pay.

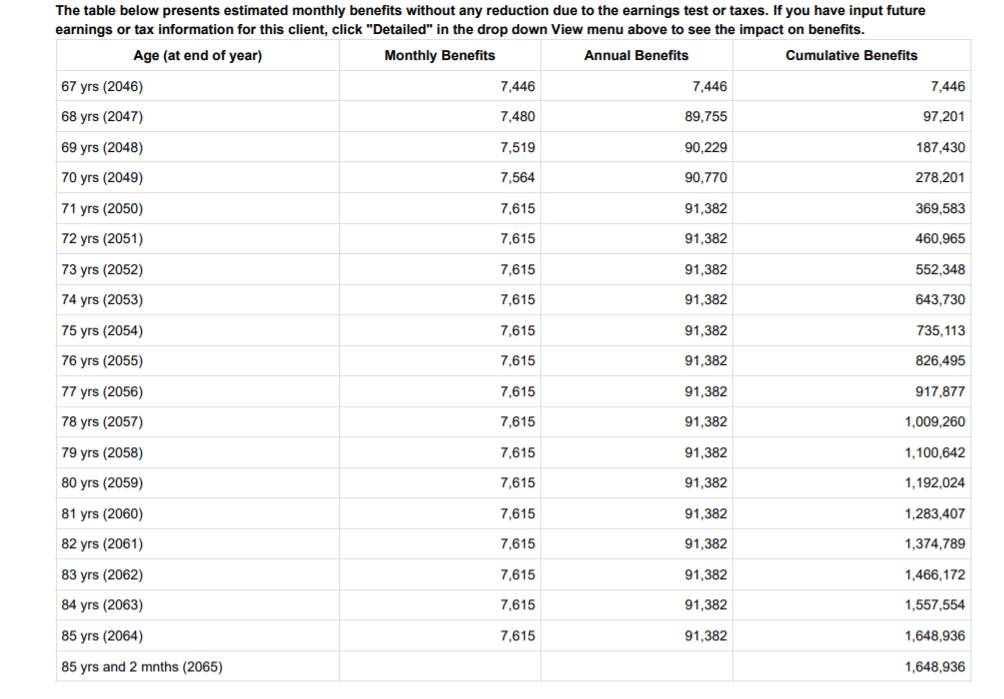

The analysis below shows a high earner, currently age 40, who is expected to have a benefit of about $90,000 per year at her full retirement age of 67.

Source: SSAnalyzer

Strategy for paying into Social Security if you are self-employed

It may seem like a simple assumption that paying lower taxes (in general!) is best. Many of us can fall into the mindset of deduct, deduct, deduct away like there is no tomorrow!

Let’s slow down and look at the bigger picture and where you are in your career, time to retirement, etc.

Remember how we said that your benefits are determined by your 35 highest earning years? Maybe you feel that you’ve earned what you earned and paid taxes on it, and so now maximizing your earnings isn’t such a priority. If so, then good for you!

Congratulations on having checked that box!

In this case it may make sense to take all applicable deductions, minimize taxes, and reduce earnings. It won’t affect your Social Security benefits as your highest earning years have already come and gone.

But what if you are still in the thick of things? If you are currently in a place where your focus is maximizing your earnings (you money making machine!) remember this. Deductions may sound like a good way to take the edge off the tax bill, but by lowering your earnings, you are taking down the level of Social Security benefits that you will receive.

As we mentioned before, this is a delicate kind of issue and not one that is easily determined by reading a blog by someone like this. Consult a tax or financial professional if you want specific advice pertinent to your situation.

What self-employed people should do today to prepare for retirement

So far in this blog we have 1) covered the basics about social security and retirement for the self-employed and 2) taken a deep dive into Social Security taxes. In this final section, we are going to give you the bottom line about what you should be doing to get the most out of Social Security as a business owner.

#1 Map out your sources of retirement income

Some self-employed people paying into Social Security liberally are going to be expecting the benefit to play a big part in their retirement. For others, the sale of the business and alternatives income streams will be how they support themselves after retiring from their business.

Sit down and map out each and every source of income. This may help to reduce some of the uncertainty that business owners inevitably face. Some typical sources would be:

- Social Security

- Retirement plan distributions

- Investment interest and distributions

- Consulting income

#2 Plan your business exit strategy

For many business owners, the business is their largest asset and the source of the majority of retirement funding. Yet self-employed business owners, knowing full well that they will have to sell their business at some point, commonly neglect to do any planning for this event until the last minute.

Talk about throwing caution to the wind!

Even if you aren’t planning to sell your business for many years, that doesn’t preclude you from doing the necessary prep work. Examples of things that business owners should be doing to prepare for the sale of a business would include:

- Identifying internal and external successors

- Getting valuations for all tangible and intangible assets (machinery, patents, etc.)

- Getting an independent third party to conduct a valuation of the enterprise

Looking out far ahead will give you the runway to handle any issues way in advance. This type of planning should be ongoing. This is the level of consistent diligence that is necessary given the magnitude of this event.

#3 Verify your earnings with the Social Security Administration

Although we would love to put all our faith in the Social Security Administration, the truth is that they don’t get it all right all the time. There have been instances in which Social Security numbers got confused and individuals were tagged with the incorrect earnings history.

For this reason, we recommend that the self-employed request a free earnings history report from the Social Security Administration. Visit https://www.ssa.gov/myaccount/. If you are a new user, create an account.

Summary of self-employed Social Security

Hopefully we’ve given you enough information about Social Security for the self-employed to get you started. For a Social Security checklist of things that you should be doing now as a business owner, send us an email.

Sources

Brandon, Emily. (2023, January 17th). US News. What Is the Social Security Tax Limit? https://money.usnews.com/money/retirement/social-security/articles/what-is-the-social-security-tax-limit

Miller, Stephen. (2022, October 13th). SHRM. 2023 Social Security Wage Cap Jumps to $160,200 for Payroll Taxes. https://www.shrm.org/resourcesandtools/hr-topics/compensation/pages/2023-wage-cap-rises-for-social-security-payroll-taxes.aspx

Social Security. Workers with Maximum-Taxable Earnings. https://www.ssa.gov/oact/cola/examplemax.html

Social Security. https://www.ssa.gov/myaccount/

Social Security Credits. https://www.ssa.gov/benefits/retirement/planner/credits.html