It’s very common for us to get questioned about whether or not a retiree can get a mortgage. Some retired people feel stuck; they want to change their housing situation, but are worried about not being able to get the financing. Don’t despair! The good news is that it is possible. In this blog we’ll talk about the importance of retirement income planning and the role it plays in allowing you to achieve your financial goals.

Before we get into the blog, we are financial planners in Morristown, New Jersey. We’ve written other blogs on retirement that may be useful to you:

Our easy, clear take on the question of if Social Security increases with inflation

End of year financial planning

What to do When Your Social Security Benefits Are Reduced

And now let’s get into it!

How do I get a mortgage when retired?

Before answering the question of getting a mortgage while retired, we first need to discuss the process for getting a mortgage.

Getting a mortgage is best described by a six-step process:

#1 Get an idea of what you would generally like to spend

This may vary based upon the housing market in your area. For example, people who live in Manhattan, New York are likely going to need to spend way more than someone who lives in a small, rural town in New Hampshire.

Set your personal limits and hold firm to them. Don’t let some mortgage broker convince you that your dream home can be yours for a loan amount significantly larger than what you are comfortable with. Remember it’s you – not the broker – who has to pay for it all and still be able to afford to live in the way you are accustomed to. Their interests may not align with yours – be ready to stand firm.

#2 Gather documentation related to your income, assets, liabilities, and capacity to take on more debt

How does a retiree get the income needed to qualify for a mortgage? Although you may not be working (some of you may still be employed part-time), that doesn’t mean you don’t have a sustainable income stream that may count. In other words, it’s not just W2 wage earners who can get a mortgage.

Many investments throw off cash flow that are considered income.

- Stocks and REITs pay dividends.

- Preferred stocks pay preferred dividends.

- Bonds pay interest payments.

This income is reported and can be verified using Form 1099 for tax purposes.

In addition, after age 72, by the SECURE Act, you are required to take Required Minimum Distributions from your qualified retirement accounts such as IRAs and 401k plans. For many retirees this, along with annuitized streams such as Social Security and any annuities you may hold, is a large source of their wellbeing in retirement. These distributions are part of a retiree’s income.

Investment accounts and Trusts are often arranged to make recurring payments to a retiree’s bank. This can be another source of income that helps to qualify for a mortgage.

How does a pre-retiree know how much income they’ll likely have in retirement? We’ll get to that later in the blog.

#3 Apply for a loan

You can use online mortgage tools to get a sense of how much of a mortgage you are eligible for, based upon the information in step #2. Once you are ready, speak with a mortgage broker. Each one handles the process differently.

Some brokers may conduct a prequalification (based on your gathered information, not a credit report) prior to preapproval (the lender actually conducts a credit check and examined your documents.)

Other brokers may view prequalification and preapproval as the same thing.

#4 Make an offer on a home

Once you have secured a mortgage, the next step is to go through with finding a home and making an offer on it.

#5 Get the home inspected

Don’t skip over this step. Once you own the home, you own it; you’ll be responsible for all the liabilities that come with it. Are there annoying neighbors? Is it in a flood zone? Are there termites? Know what they are.

#6 Close the loan

Closing is the when the ownership of the property is transferred, technically. The deed of the house is transferred to your name, and closing costs are paid.

Closing costs are usually up to 6% of the loan amount, and may include application fees, attorney fees, loan origination fees, etc. – the list is long! Make sure you know in advance what you’re in for.

What is retirement income planning?

Any application for a mortgage in retirement should be done in concert with sound retirement income planning.

“What is that?”, you may ask.

Retirement income planning is the process through which a retiree’s income is managed in order to allow the person to afford the cost of living. As retirement is usually the decumulation stage of a person’s life, it is important to have a plan for how to most efficiently convert the retiree’s existing asset base into a stream of income. Retirement income planning is best achieved through a careful analysis that incorporates relevant aspects of the retiree’s tax, financial, and estate plans.

Sample financial plan

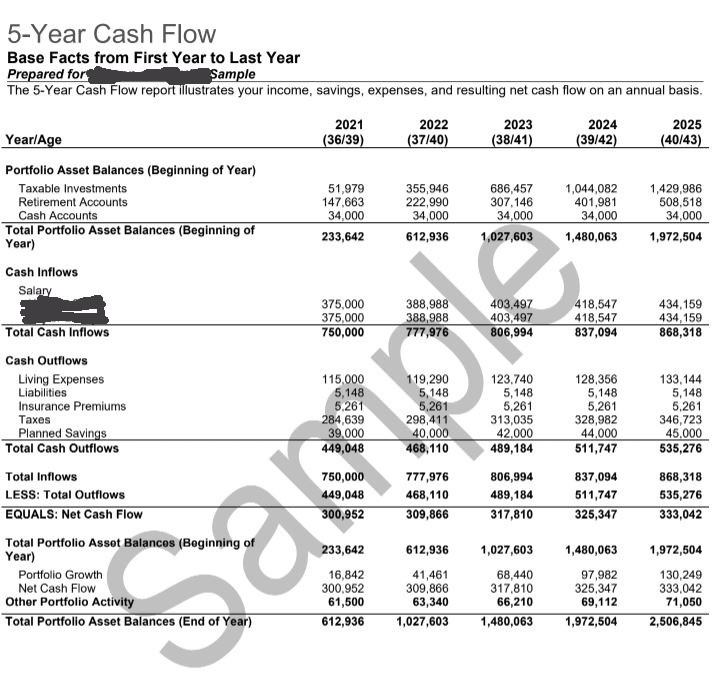

This excerpt from a financial plan below is an example of a tool that could be used when a retiree is looking to get a mortgage and needs input to make the decision about how large an amount of debt he or she can take on, etc. A 5-year cash flow report is often part of a retiree’s financial plan. It projects out what your cash inflows and outflows are likely to be.

As each retiree is different, the components of your financial plan will differ as well. Here are the possible components of a financial plan for a retiree.

A financial planner:

- Guides you to think about areas of your financial life you may not have considered.

- Formalizes your goals and puts them in writing.

- Helps you prioritize your financial opportunities.

- Helps you determine realistic goals.

- Suggests creative alternatives that you may not have considered including the best way to claim Social Security.

- Reviews and recommends insurance options to protect your family, including life insurance, disability, and long-term care.

- Assists you in setting up a company or individual retirement plan.

- Assists in preparing an estate plan for you.

- Helps you develop a legacy plan for future generations or charitable organizations.

- Reviews your children’s custodial accounts and 529 plans.

- Develops both accumulation and distribution strategies to support retirement goals.

- Helps you determine your IRA Required Minimum Distribution.

- Checks with you before the end of the year to identify any last-minute financial planning needs.

- Suggests alternatives to lower your taxes during retirement.

- Reviews your tax returns with an eye to possible savings in the future.

- Stays up-to-date on tax law changes.

- Repositions investments to take full advantage of tax law provisions.

- Works with your tax and legal advisors to help you meet your financial goals.

- Monitors changes in your life and family situation.

- Proactively keeps in touch with you.

- Provides referrals to other professionals, such as accountants and attorneys.

- Helps with the continuity of your family’s financial plan through generations.

- Facilitates the transfer of investments from individual names to trust, or from an owner through to beneficiaries.

- Keeps you on track.

- Develops and monitors a strategy for debt and expense reduction.

- Is a wise sounding board for ideas you are considering.

- Provides independent, transparent, and honest advice.

As you can see, helping you buy a house at age 55 isn’t the only item on the agenda!

Did our tips on getting a mortgage when retired help?

We hope you’ve enjoyed our blog on how to get a mortgage if you are retired. Yes, retired people can and do get mortgages all the time. But how do you know if this is right for you?

We are financial advisors in Morristown, NJ serving the local community and beyond. If you have questions about your retirement, getting a mortgage, retiring in New Jersey, moving there, affording to live there, or (like us) are just plain old Bruce Springsteen fans, reach out and send us a message.

Sources

Crace, Miranda. (25 October, 2022). Rocket Mortgage. Closing Costs: What Are They, And How Much Will You Pay?. https://www.rocketmortgage.com/learn/closing-costs

IRS. Retirement Plan and IRA Required Minimum Distributions FAQs. https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-required-minimum-distributions