We’re often asked if buying a Jersey Shore home is a good investment. While we can’t answer that specifically with a “yes” or “no”, here is our take on how to approach the question of whether or not you should buy a New Jersey vacation home.

Before we get started, you may want to check out other New Jersey finance blogs we’ve written:

A checklist for moving to Morristown, NJ from NYC

What is the average income in New Jersey?

Buying a New Jersey vacation home – pros and cons

Let’s talk about how to approach the decision of whether or not to buy a vacation home in New Jersey. Just one caveat; we can’t comment with a definite yes or no specific to anyone’s personal situation. The information in this article should not be construed as advice; for specific recommendations, please consult with your tax or financial advisor.

Now back to the subject at hand!

Consider the potential benefits and drawbacks that come with buying a vacation home in New Jersey.

The pros:

- Potential appreciation of your asset. According to the Zillow Home Value index, the average price of a home on the Jersey Shore is $182,668. This is up 13.7% from last year, and more than $40,000 from its low in June of 2017.

- Mental health is important, and enjoying time on the shore can improve your peace of mind.

- If you are considering retiring in New Jersey, the coastal towns are quiet during the offseason and may provide tranquility.

The cons:

- Real estate in certain New Jersey beach towns can be very expensive for the buyer. (See first bullet in the “pros” list above).

- You would be taking ownership of an asset that will be vacant for most of the year, versus investing in other assets that may have higher yearly utility.

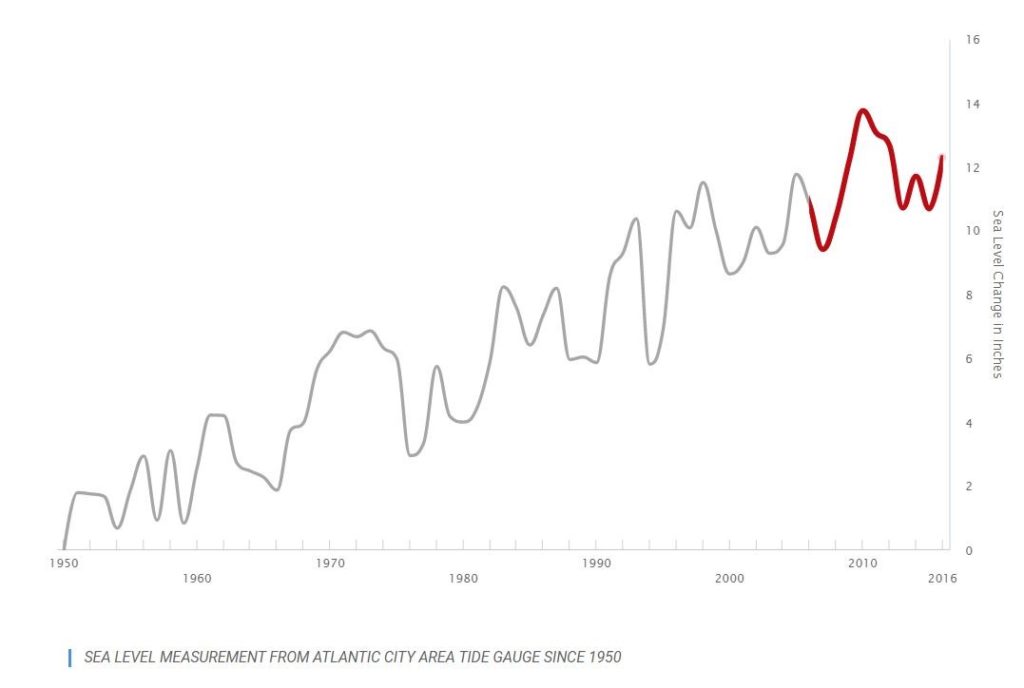

- There is a high flood and storm surge risk in areas such as these, and it’s only getting worse. According to Sealevelrise.org, the sea level has risen 12 inches off New Jersey’s coast since 1950.

Look at this graph below from SeaLevelRise.org, depicting the sea level rise in the area around Atlantic City!

This is costing the state of New Jersey billions, and may also become a financial strain for inhabitants whose property may be damaged.

Rent vs. buy on the Jersey Shore

The decision to rent vs. buy a New Jersey vacation home is a bigger question than it appears. Financially it can be a big move to make. If you are buying a second home, you will be required to shell out cash for the down payment and closing fees, as well as any additional monetary commitments that come with owning the home (such as NJ property taxes). Did you map out the cash flow and financial plan for this investment?

The benefit is that owning property means you hold an asset (and in the case where you would own real estate on the Jersey Shore, one located in a high growth market) with the potential to increase in value over time.

On the other hand, renting a vacation home on the New Jersey Shore would mean you’re handing out rent money to a landlord without enjoying any potential upside from having an investment in the property. However, you aren’t on the hook when the boiler breaks.

According to the St. Louis Fred, the home ownership rate in New Jersey was 64% in 2020. This means renters are a significant part of the population – it may not be that easy to obtain the rental property you want.

Questions to ask yourself when considering a New Jersey vacation home

Here are five important questions to think about if you want to buy a home on the Jersey Shore or anywhere on the New Jersey coast.

- Am I prepared to handle the consequence of any natural disasters that may occur, affecting my property and/or causing my taxes to rise?

- What is the intended use of the home for the months it is idle?

- Have I created a financial plan for this, and am I prepared to deal with the financial costs, taxes, and the time commitment required to own two homes?

- Do I really need to own a home or is renting an acceptable option?

- How viable an investment is this versus other properties or assets that I may consider owning?

Final thoughts

Those are our thoughts on buying a vacation home in New Jersey. Is investing in Jersey Shore real estate for you? We can’t say – but if you are entertaining this decision, we’d be glad to talk it over with you.

As financial advisors in Morristown, NJ, serving clients across the country, we encourage you contact us if you wish to discuss your personal financial situation.

Sources

Sealevelrise.org. New Jersey. New Jersey’s Sea Level Is Rising and it’s costing over $2 Billion. Retrieved from https://sealevelrise.org/states/new-jersey/

U.S. Census Bureau, Homeownership Rate for New Jersey [NJHOWN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NJHOWN, March 8, 2022.

Zillow. Jersey Shore Home Values. Zillow Home Value Index. Retrieved on March 8, 2022 from https://www.zillow.com/jersey-shore-pa/home-values/