As we pay inflated prices for a small bag of groceries, it’s always natural to think to yourselves, “Would moving to Morristown from NYC be such a bad idea?” If moving to New Jersey from New York is something you’re considering, here’s our checklist of items to think about.

Before we get started, you may want to check out other New Jersey finance blogs we’ve written:

5 must-know benefits of retiring in Morristown NJ (aside from Bruce Springsteen)

A checklist for moving to Morristown, NJ from NYC

What is the average income in New Jersey?

What is the New Jersey 529 Plan and should I use it to send my kids to college?

Should you buy a New Jersey vacation home?40 questions to ask a financial advisor in New Jersey

#1 Lifestyle changes

As long term residents, there are many reasons we love living in Morristown, New Jersey. It’s a good, safe, place to raise a family. The same is true of many locations in New York City, however the vibe in Morristown is a bit more laid back. There are many community attractions and the beautiful Morristown Green that make living there a pleasure.

Many Morristown residents enjoy the slower pace lifestyle while commuting to the City for work on the weekdays. And on that note – how long does it take to get from Morristown, New Jersey, to Manhattan? Usually it is about a 60-90 minute train ride, depending on time of day.

#2 Cost of living differences

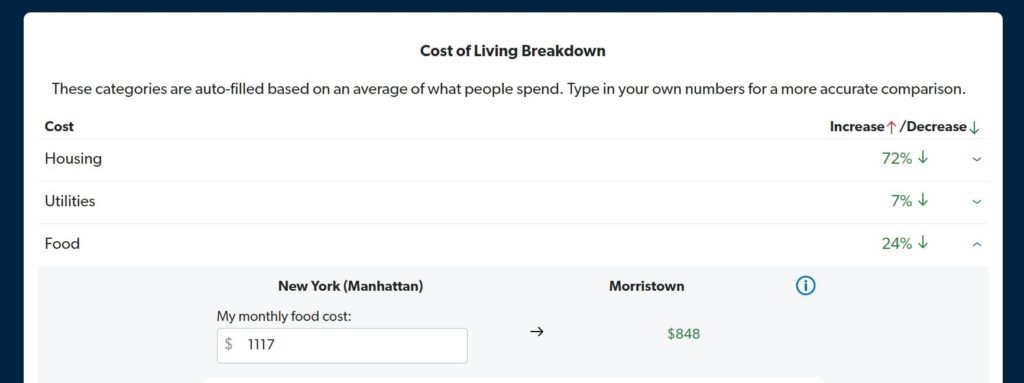

According to Ramsey Solutions, an individual earning $100,000 in New York City would only need about $48,000 to sustain the same quality of life.

- Housing is the major difference. A three bedroom, two bathroom house in Manhattan would cost over $2.3 million. But in Morristown, it would cost a little less than $487k. This is a difference of almost 72%.

- Utilities and healthcare are more expensive in New York City than in Morristown, but not by that much.

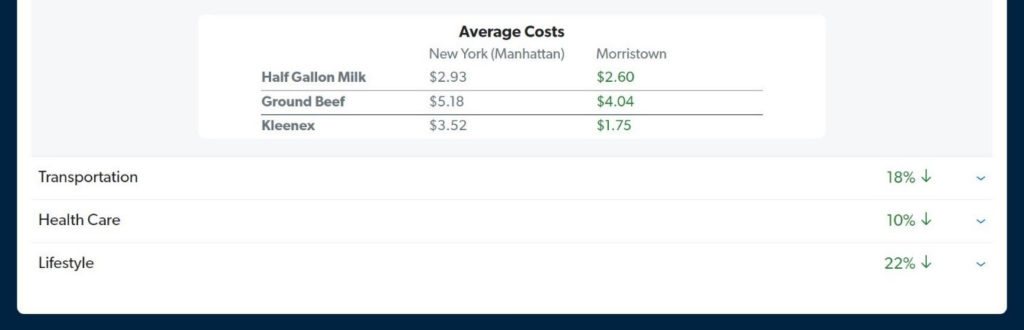

- Food is significantly more expensive in New York City than in Morristown. A monthly food budget of $848 would need to be $1,117.

And if that isn’t a case for moving from NY to NJ, then what is?

#3 Tax differences

There are several differences in the taxes paid by residents of New Jersey and New York, as captured by the table below. Although New Jersey income and property taxes are higher, state and local taxes are higher in New York. New York City residents are also subject to city tax.

Tax differences between New York and New Jersey

| Top individual income tax rate | State and local tax burden | Combined state and average local sales tax rate | Property tax as a percentage of property value | |

| New Jersey | 10.75% | 12.2% | 6.6% | 2.21% |

| New York | 10.9% | 14.1% | 8.52% | 1.4% |

Source: Tax Foundation

Many people who live in New Jersey and work in New York often worry about paying double tax. This issue is solved quite simply; you file and pay tax where income is earned (New York), and then receive a deduction to apply to your state taxes (New Jersey).

However, as individual circumstances can differ, it’s important to remember that for tax advice the best course of action is to ask an accountant or tax advisor. This is especially critical if you are thinking of, or are in the midst of, moving from New York to New Jersey.

#4 Estate planning changes

As both New York and New Jersey are equitable distribution states, there would be no difference in division of property were you to divorce in New York versus New Jersey.

However there are other variations between the two states in terms of estate law:

- New Jersey has no estate tax, while New York does

- New Jersey has an inheritance tax, while New York does not.

- It is important to consider re-evaluating guardianship for any dependent children, as in-state guardians are preferable over out-of-state.

- Healthcare proxies, wills, and estate documents may require review.

- The probate process is not the same between the two states.

We recommend that as an alternative to trying to navigate the differences between estate law in New York and New Jersey on your own, you should consider consulting an attorney or legal advisor.

Still game to move to Morristown from NYC?

If a move from New York to New Jersey is on your mind and you have questions, let’s talk. We are financial advisors in Morristown, serving the local area and beyond, although we do frequent the City quite often.

Sources

Tax Foundation. Taxes In New Jersey. https://taxfoundation.org/state/new-jersey/

Tax Foundation. Taxes In New York. https://taxfoundation.org/state/new-york/

Ramsey Cost of Living Calculator. Retrieved in January 2022. https://www.ramseysolutions.com/real-estate/cost-of-living-calculator

Nolfo, Matt. Differences in NY and NJ Estate Planning. Mathew J. Nolfo & Associates. http://www.estateandelderlaw.net/differences-in-ny-and-nj-estate-planning/