Here’s a quick summary of what we’ve been seeing in the market this year.

Despite fears of recession, GDP seems to be intact with third quarter numbers coming in a touch above 5%, slightly exceeding analyst expectations (Osaic, 2023). This is far above the long-term average GDP annual growth rate of 2% (Ibid). Price levels seem to be dropping as disinflation continues although inflation is still a touch above what it has been historically.

This is all looking good for the economy. Inflation is moderating, and this bodes well for consumption, which drives two thirds of all economic activity. Robust employment numbers are also a good sign.

There may be change in behavior from the Fed if inflation continues to drop while GDP remains strong. In such a case we would expect to see rates hold steady or decline in 2024. After a series of back-to-back rate hikes in 2022-2023, the Fed has now taken a pause and it will be interesting to see what type of stance they adopt going forward. Lower rates mean looser credit, which spurs the economy’s growth engine.

How does this potentially impact you?

The picture looks good for financial assets as we move to 2024, although nothing can be predicted with certainty. Lower interest rates prop up bond prices, and strong GDP is generally beneficial for the stock market. For those of you who own businesses, a stronger economy is generally supportive of business growth.

Here is a quick recap of what the market has done. The return on the S&P 500 has been 23.92% year to date, as of December 19th, 2023.

Bonds have been flat, returning only 0.27% over the same timeframe.

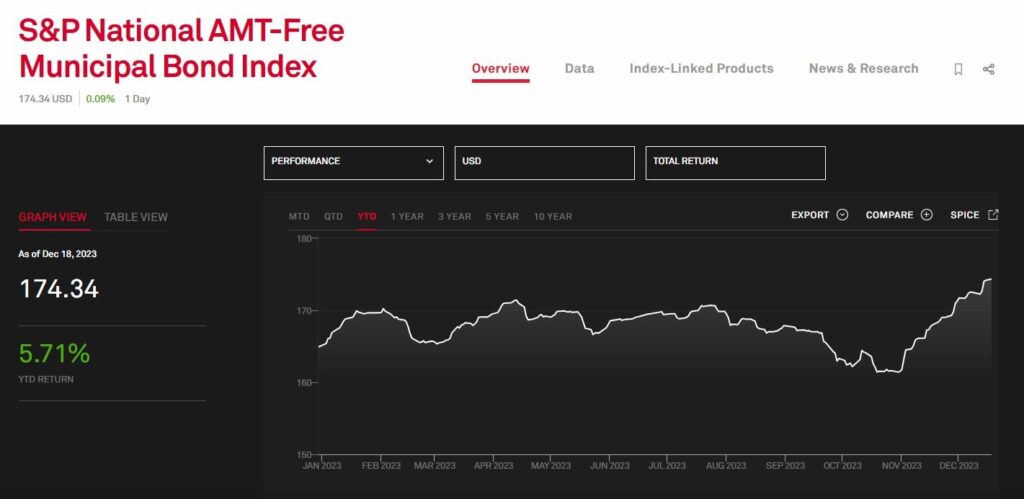

Municipal bonds have done slightly better, returning about 5.71% as of December 19th, 2023.

Having said all this, the market can never be predicted and a strong economy is no guarantee of market performance. The best defense against anything that can happen next year, or at any point in time, is to be prepared with a portfolio that allows for growth while staying within your risk tolerance band, coupled with a sound financial plan that takes your life goals into account. In the long term, this is the most productive.

Happy holidays and if you would like to revisit your portfolio or financial plan, please contact us to set up a time.

-Judd

Sources

Blancato, Philip. 1 December, 2023. Osaic. Market View Weekly.

CNN Business. S&P 500 Index, year to date. Retrieved on December 19th, 2023 from https://money.cnn.com/data/markets/sandp

Yahoo!Finance. iShares Core U.S. Aggregate Bond ETF (AGG). Retrieved on December 19th, from https://finance.yahoo.com/quote/AGG/

S&P Dow Jones Indices. S&P National AMT-Free Municipal Bond Index. S&P Dow Jones Indices. Retrieved on December 19th, from https://www.spglobal.com/spdji/en/indices/fixed-income/sp-national-amt-free-municipal-bond-index/#overview

Past performance is no guarantee of future performance.