Typically business owners and the stock market have been like oil and water. Most don’t have the extra cash to invest, and if they do many times they direct funds into real estate or investing in another business. This article will cover the 5 biggest finance and investing mistakes we see business owners making – and offer financial tips for small business owners who want to manage finances for their businesses. Don’t worry – we’ll make it fun, practical, and relevant to your professional and personal objectives.

Mistake #1: Not investing at all

Let’s start with a discussion of why business owners are typically not investing.

For many business owners, their net worth is tied up in the business. They tend to invest profits back in the business as much as possible. Allowances are taken to cover living expenses, and this is done on an as needed basis. Saving money comes last or not at all.

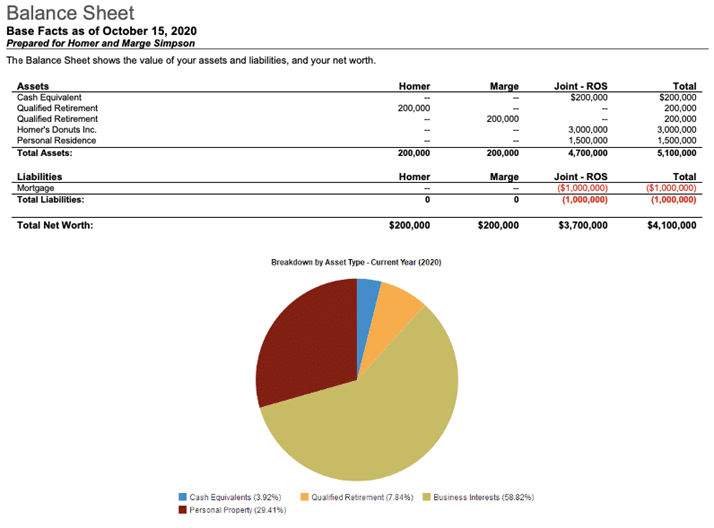

Here is what a typical business owner’s financials tend to look like:

It might get you by in the day to day, but here’s the problem with an arrangement like this. If the business goes away then so does the worth. It’s the quintessential scenario of putting all your eggs in one basket.

It’s a misconception that in order to become wealthy, one has to sock away large amounts of money at the expense of all else. This kind of saving strategy is overwhelming for most people, and it may even be impossible for most business owners. Moreover, it is a myth. If you look at the way that wealth accumulates it may not even be that necessary.

Mistake #2: Not taking advantage of compounding

Most business owners are too busy to invest their money, missing out on one of the most relevant money forces to a business owner – the power of compound interest. They’ll move cash into their investment account and then let it sit there idle. Doing this causes you to miss the opportunity to experience the power of compound interest.

What is compounding?

By definition, compound interest is what results from reinvesting the interest or dividends that are generated by an asset. Compound growth is exponential because it occurs cumulatively. As earnings are added to the asset, they form a bigger base off of which future interest or dividends grow.

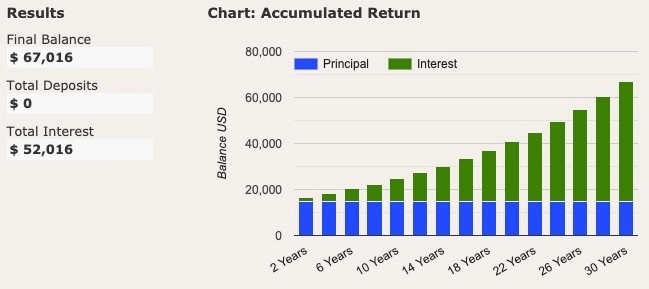

We don’t want to get too technical here, but the following illustration shows the growth of $15,000 over 30 years.

Source: helpfulcalculators.com

The main point here that is relevant to business owners is that consistency wins in this scenario. You can see that by summoning the power of compounding, your money grows without you having to do anything. Time is on your side with compounding. Even if you do nothing other than just let the money sit there, it will grow on its own.

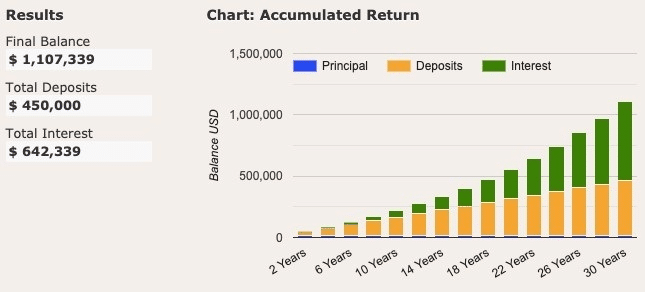

Now, let’s suppose that you are able to be a bit more consistent. Let’s say you somehow manage to put a small sum of money away each year. The following illustration shows what would happen if you added $15k to your initial nest egg.

Source: helpfulcalculators.com

Mistake #3: Pile on the illiquid assets

Many business owners like real estate. Instead of directing their money into investments that exist in the abstract – stocks or bonds – they favor investments that are more concrete. Sometimes business owners will own properties or real estate that are related to their business.

There’s nothing inherently wrong with this. Real estate can be a great way to create a flow of income for yourself, if you are renting out your property. As rents rise with the cost of living, there is also an element of inflation protection built into being a landlord for a property you own. On top of all this, there is also the potential for capital appreciation of the assets over time.

There are some drawbacks.

- Real estate is illiquid. Transactions occur buyer to buyer. They are private. Because it’s not traded on an exchange or in a public market, deals can take longer to occur. It may be a challenge to divest of an asset without selling for lower than its value.

- Maybe you are investing for income, renting out a property you own and acting as landlord. Don’t forget that the time you commit to this does count as a cost. Albeit an implicit cost rather than a cash outlay, it does take away time that you could be committing to your business.

- In bad markets, real estate values do dive. This could lead you to have negative equity or have to seek out additional funding.

- If you’re a landlord, you are at the mercy of your tenants’ ability to pay the rent. They may honesty want to, but not be able to if for example they lose their job or face financial stress.

The key to investing is balance. Your portfolio can be diversified among liquid and illiquid assets. As long as the illiquid assets are held in a proper ratio to the liquid assets, you face less risk of a liquidity crunch. As a rule of thumb, we feel that 10% of a portfolio should be held in illiquid assets. This seems to be the comfort zone for most investors, although it can vary significantly based on net worth and cash flow needs.

Mistake #4 – Not taking advantage of retirement plans

There are several reasons why business owners fail to get the most benefit out of retirement plans at their company. The first reason is that they think it’s too complicated, which leads them to put it off for too long. They often fail to update retirement plans that had been put in place a long time ago. For example, many employer sponsored retirement plans do not include a Roth option or neglect considering alternative plan types like Defined Benefit, Health Savings Accounts, and cash balance plans.

Mistake #5 – Over saving for estimated taxes

We often hear from business owners that they want to invest but have to hold onto their money to pay their estimated taxes. They know they have some ballpark figure for the amount of tax they will pay, but rarely is there any real clarity. This leads them to miss the opportunity to invest consistently – and in some cases, may lead them to not invest at the intended time.

5 financial tips for business owners

#1 Outsource your investments

It’s ironic how many business owners can be so logical about running their businesses yet micromanage their own personal financial lives. If you are piling cash into an investment account, but never have the time to invest it – this means you. This financial tip for business owners is plain and simple: hire someone to invest for you.

Some financial advisors have deep knowledge of business owner finance and are well suited to manage your investing needs and also the financial planning that business owners need. We’ll get to that in a few minutes but for now, think about finding a financial advisor with these qualities:

- Operates prudently and in your best interest at all times

- Can look at your personal finances and your business finances at the same time

- Has a focus not just on investing but also on the financial planning, estate, and tax aspects of your life

This is not an exhaustive list and your needs will be specific to you and your tendencies. However it’s generally a good idea to interview a few financial advisors before making the decision to work with any one in particular. References are great to check on before you sign the papers.

#2 Think about a defined benefit plan

Many times when people think of defined benefit plans, they think of big corporations with deep pockets. This is a myth. Defined benefit plans can be great for small businesses. There are several reasons but the most significant one is that it allows you to put away far more money pretax than most other retirement accounts such as IRAs or 401ks.

Let’s say that you are a business owner, age 60, and your annual income is $500,000. Here is what it would look like if you were to contribute to a traditional retirement plan.

- You could make a $19,500 contribution and a $6,500 catch up contribution (pre-tax) into a 401(k). [1]

- You could contribute $7,000 pre-tax to a Traditional IRA. [2]

- You would be ineligible to put money into a Roth IRA. [3]

Now, let’s think about how this would work if you set up a Defined Benefit Plan. Let’s say you are a 60 year old business owner with three year average income of $500,000 and zero employees, and your business has been established for more than 10 years. In the first year, a maximum contribution of well over $100,000 can be made to the plan on a pre-tax basis. [4]

Now that’s quite a difference, isn’t it?

First of all, what is a defined benefit plan? It is a retirement plan set up by an employer that provides a fixed benefit to employee when they retire. The payout is determined by actuarial assumptions that are based upon age of participants, projected returns, etc.

It’s important to note that all risk in this scenario lies with the business owner. The company, not the employee, makes annual funding contributions each year. These contributions are invested in accordance with the risk and return assumptions set by the actuaries. The goal is to grow the funds to the required level so that payouts can happen as planned.

This tip about finance for small business owners comes with a caveat: a defined benefit plan only makes sense for your business if you are willing to shoulder the administrative fees and outsource the maintenance of the plan to a third party.. Although these fees will be significant, the hope is that the savings you reap by putting away more money on a tax-deferred basis will outweigh the costs.

#3 Consider the Roth 401(k)

The list of available retirement plans isn’t limited just to 401(k)s and defined benefit plans. There are many alternatives. For example, Roth 401(k) plans have become popular. A Roth 401(k) is a retirement vehicle into which you make post-tax contributions. The money grows on a tax-free basis. Just like a traditional 401(k), a Roth 401(k) can include a matching option and has contribution limits determined by the IRS.

One of the benefits of using a Roth, as opposed to Traditional, 401(k), is the relief from uncertainty about tax laws. Nobody can predict what tax rates will be in the future. This brings us to another tips for business owners: there is great comfort in knowing that you have already paid the IRS what is due and you don’t have to worry anymore!

#4 Planning out estimated taxes

Many business owners set aside too much in cash reserves to use as their estimated tax payment. This problem can be solved by acting strategically.

Speak with your accountant about the amount likely to be owed. Be sure to build in a cushion in case the taxes owed comes out to more than you expected. Compare this to what you have currently set aside, and move the excess cash into an investment account. You can either invest it yourself or appoint a financial advisor to do so on your behalf.

#5 Ensuring proper insurance coverage

A lot of businesses are very valuable, yet totally dependent upon the owner – and implicitly the chance that they stay alive. We’d like to believe we have control over this but nobody does.

Life insurance decisions are often made taking the owner’s personal obligations into account and neglecting his or her value to the business. As a general tip on business owner finance, we recommend that business owners maintain 5x to 10x their business’s profit in Life Insurance coverage depending on their age.

Conclusion on business owner financial tips

Investing for business owners has many dimensions. We hope our financial tips for business owners have been helpful

We are financial advisors in Morristown NJ serving clients across the country. If you have questions or would like to discuss anything we have covered in this article, please get in touch with us.

Sources

Helpfulcalculators.com. Compound interest calculator. Retrieved from http://www.helpfulcalculators.com/compound-interest-calculator

PensionDeductions. Defined Benefit Calculator. https://www.pensiondeductions.com/defined-benefit-calculator/

TIAA. IRA Contribution Limits. https://www.tiaa.org/public/products-services/ira/calculators/eligibility

Footnotes

1 Ubiquity Retirement Solutions

2 TIAA

3 TIAA

4 Pension Deductions