The global investable market is defined as the companies that trade on an exchange and are available to the public for investment.

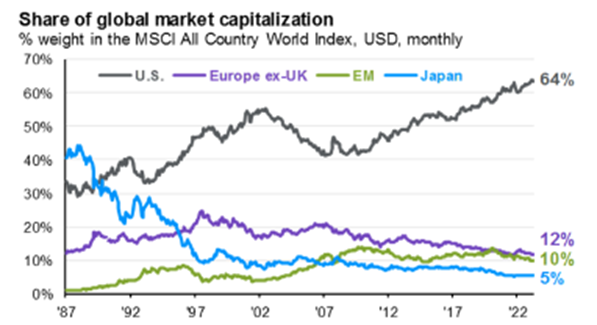

The chart below from JPMorgan tells an interesting tale about how the global investable market has changed over time.

- The share of US equities as a percentage of MSCI All Country World Index shows a dramatic uptick, measuring at 64%. If you look at the 2000’s, this hovered in the range of 40-50%.

- In 1987, Japan held the highest share of market capitalization (at 40%) and it now holds the lowest (5%).

- The global market portfolio has become vastly concentrated in US equities. There is a wide spread between the US, representing 64% of market capitalization, and the next highest weighting, held by Europe, at 12%.

What do these changes in the structure of global markets mean for investors?

The graph is showing that US market capitalizations have grown significantly versus the rest of the world. This is perhaps due to the run up of the Magnificent Seven, as we’ve written about in our newsletter about market concentration.

This trend is not as much an indication of overall market growth in the US as much as a sign that market appreciation has gotten “clumpier,” with a few stocks showing massive outsized gains versus the rest of their US equity counterparts, as well as the rest of the world.

While stock price run ups aren’t something investors usually complain about, it is something to be aware of. Concentration risks must be managed. It’s important to make sure your portfolio is balanced between large, mid, and small cap stocks, and possibly international. All of this must be customized, however, to your personal risk tolerance and goals. If you would like to discuss, please set up a time to meet with us.

-Judd

Sources

2024, June 30th. J.P. Morgan Asset Management. 3Q Guide to the Markets. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/