Most people operate with the goal of saving as much as they possibly can. If you want to figure out if you are saving enough, you can always sit down and model it out. But in case you haven’t done so, here are some quick tips to get you started thinking about it.

How much should I be saving for my age?

You may have heard the rule of thumb that by age 50, you have saved six times your salary.

Here’s why we don’t quite agree with this “income multiple approach.”

- Some people’s pay isn’t regular – for example, business owners and the self-employed.

- For certain professions, your peak earning years may not arrive until later in life. For example, surgeons earn their most in their mid 40’s.

- Your life needs may not vary with your income. The amount of savings required for one person to retire may be far greater or less than for someone else with the exact same income.

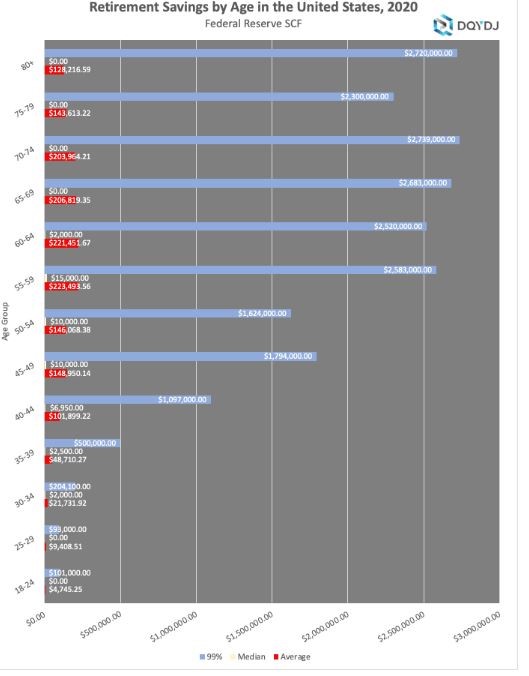

What we have found to be more useful is to look at savings rates by age, as in this chart from Don’t Quit Your Day Job.

While age may not necessarily correlate with saving rates, it does provide a good benchmark for determining how you measure up. If you are saving more than your peers, what has contributed to your success, and is there a way to modify that to increase savings even more? If you are falling below the average, how can this be improved?

If you’re wondering how to find out how much savings you have, take an inventory of the following:

- Checking and savings account balances

- Cash accumulated within any life insurance policies

- 401(k) plans or other employer-sponsored retirement vehicles (even old ones you haven’t rolled over)

- Taxable and non-taxable brokerage accounts

- Money held in a safe or safety deposit box

Are you really “maxing it out?”

We commonly hear from folks who are contributing to their company retirement plan, and leaving the rest in the bank. A ton of people don’t realize there is a whole world of investing that goes beyond 401(k)s. There are other vehicles that you can direct your savings towards, such as taxable and non-taxable brokerage accounts.

Let us know if you have questions about how to go about this approach. As always, we’re happy to chat.

-Judd

Sources

Bieber, Christy. (22 June, 2023). The Ascent. How Much Money Should You Be Saving Every Month at Age 50? https://www.fool.com/the-ascent/buying-stocks/articles/how-much-money-should-you-be-saving-every-month-at-age-50/

PK. Don’t Quit Your Day Job. American Retirement Savings by Age: Averages, Medians and Percentiles. https://dqydj.com/retirement-savings-by-age/