Happy New Year! In this newsletter we are going to recap 2022 economic news and highlight the most salient themes for investors.

Let’s start with a look at what the major indices have done. 2022 started on the heels of a 2021 bull market whose rally had not yet died out with the turn of the new year. If you recall, the Fed had completed numerous rounds of stimulus and QE had taken hold. Inflationary fears were just fears at that point; but how rapidly and how drastically it would all change as the year crept forward.

With inflation escalating and war breaking out in the Ukraine, the Fed resorted to numerous rate hikes, significant in size, to curtail the overheated economy. The result was market volatility and a market in decline.

On another note, 2022 was a tough year for the bond market, with bond prices in a state of constant decline as rate hikes sounded off. Remember that when rates rise, bond prices drop.

Outlook for 2023

As we reflect upon the prospects for the market in 2023, we can only assume that the economic tinkering will continue as policymakers figure out how to get inflation back to normal. As always, our best advice is to stay on top of your risk tolerance and adjust with any changes in life position. Long term is the mindset to be in during times such as these.

There are two noteworthy points:

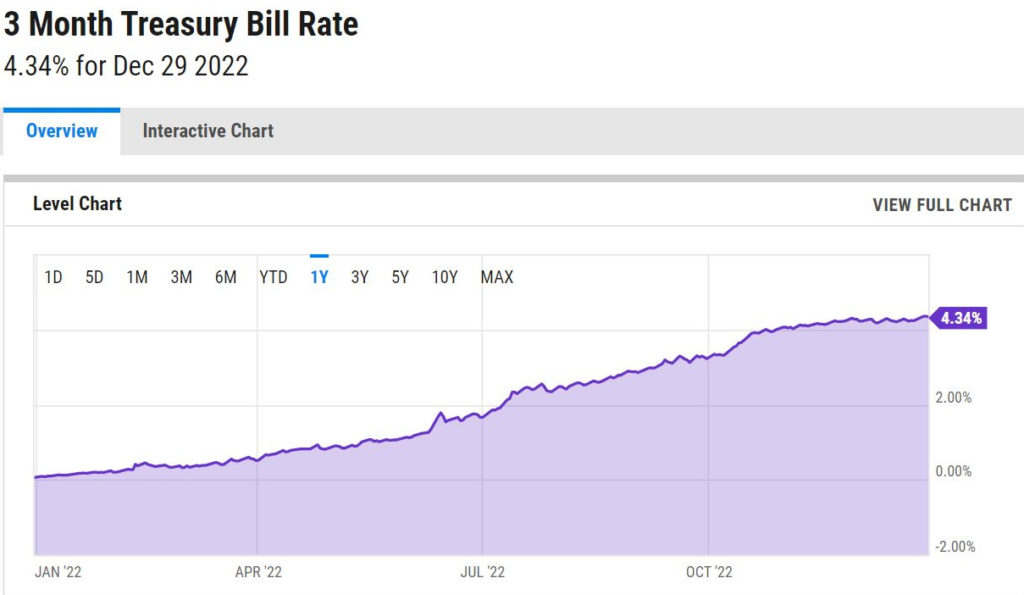

- Treasury Bills can be a critical store of value in times like these as they are backed by the full faith of the US government (which is believed to be unlikely to go bankrupt). As of the time of writing of this article, the T Bill yield has risen to over 4% after a series of several consecutive interest rate hikes by the Fed, as the graph from YCharts below displays.

- An I Bond, or a Series I Savings Bond, is a Treasury Bond that is adjusted each six months for inflation. As inflation has surged in recent months, they have gotten a great deal of attention.

Actions you should take

As a reminder, it’s best to consider your overall financial situation any time you are considering any particular investment. It is wise to map out your goals, whether they be retirement, buying a house, paying down debt, etc., and consider your cash flow needs. Any portfolio decisions should only be made after a thorough risk assessment, and should take your overall income and total return needs into account.

If you have questions about how to set up your portfolio strategically for 2023, please contact us to set up a time to speak.

Sources

CNN Business. S&P 500 Index, year to date. Retrieved from https://money.cnn.com/data/markets/sandp

Yahoo!Finance. iShares Core U.S. Aggregate Bond ETF (AGG). Retrieved from https://finance.yahoo.com/quote/AGG/

YCharts. 3 Month Treasury Bill Rate. https://ycharts.com/indicators/3_month_t_bill