Click here to sign up for our newsletter!

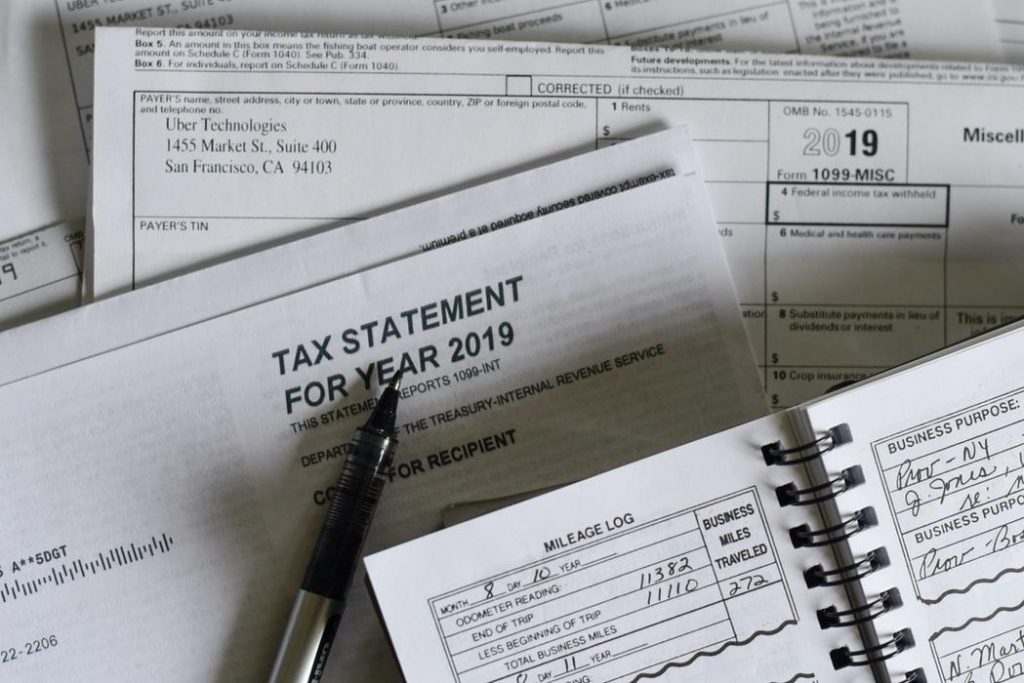

So you got some letter in the mail from the IRS.

And your heart drops.

You’re thinking something like, “I’m going to get audited and spend the rest of my days in utter misery.”

That’s how most of us feel when we get a letter in the IRS and we aren’t quite sure what to make of it. While prompt attention must be paid, most of the time this is not a cause for any great concern.

The IRS sends taxpayers millions and millions of letters for multiple reasons. Many of them are of minor consequence and do not involve an audit. Some of the most common non-examination related notifications are:

- CP2000 – Notice of Proposed Adjustment

- CP2501 – Tax Return Discrepancy

- Letter 3219 – Notice of Deficiency

- Letter 12C – Information Request

If you receive an IRS notification in the mail, stay calm and simply speak with your accountant in a reasonably timely fashion. It’s a good idea to contact your financial advisor as well. Most of the time, the financial advisor is familiar with these situations and knows what to say to your accountant. For my clients, I reach out to their accountant directly when my clients get a letter from the IRS, which makes it easier on all parties involved.

And by the way, the IRS always contacts you via mail. They never email or call. If someone is trying to communicate with you any other way, it is probably a scam. Do not respond.

Questions about anything we’ve said? Please reach out to us.